The complexity of this off-market deal arose not only from the financial figures but also from the challenging owner, tenants, and the poor property condition. The property owner had been attempting to sell this property for over three years. While the property’s valuation became a topic of frequent discussions between the owner and myself, his valuation of $2.5 million was significantly inflated and lacked supporting data. Taking into consideration the comps in the area and average property values, I calculated that, given the property’s condition, it should have traded for between $60 and $75 per square foot.

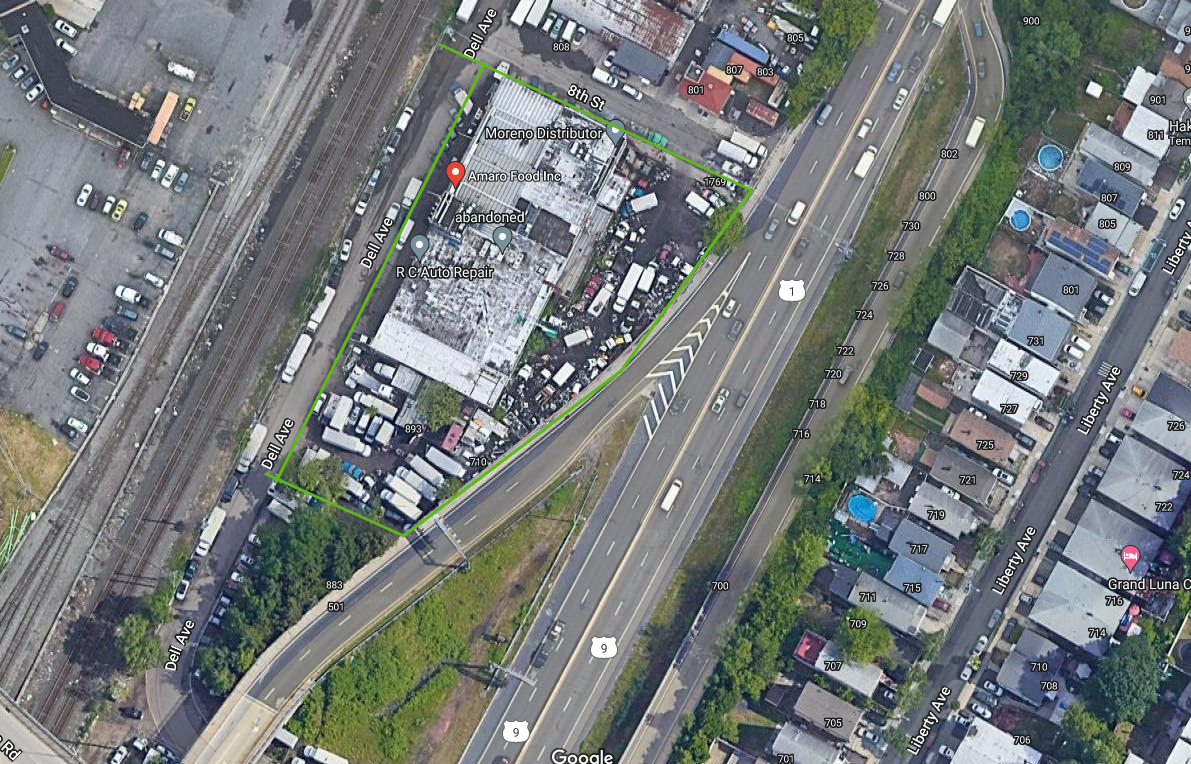

Additionally, based on income projections of $8 per square foot and factoring in a 40% expense ratio for a 16,000 sq ft property with a 6.6 cap rate assumption, I performed two valuation methods and arrived at the conclusion that the property’s true value should fall within the range of 1 to 1.2 million dollars. The property is situated within the special development district of Newark Airport and the Frelinghuysen corridor. Recognizing its potential, I understood that it would hold substantial value for an investor looking to add value or an owner seeking to establish their business headquarters.

Ultimately, I successfully secured a sale price of $1,795,000 for the property, equivalent to approximately $112.18 per square foot – a nearly 40% premium over the comparable properties. This outcome left the seller satisfied, while the buyer was enthusiastic about acquiring a property in a specially zoned area, anticipating future rental income following necessary property improvements.