B & B

Analysis Commercial Real Estate

Categorization of Commercial Real Estate Deals

These categorizations of value reflect the multifaceted nature of real estate transactions and investments, where various factors come into play to determine a property’s worth to different stakeholders.

Market Value

The most basic form of value, it’s the price a property can reasonably be expected to sell for in a competitive market. Market value is influenced by factors such as location, size, condition, and recent comparable sales.

Intrinsic Value

This is the inherent value of a property based on its individual characteristics, potential for use, and its ability to generate income or provide other benefits.

Investment Value

This is the value of a property to a specific investor or investor group, based on their investment goals, risk tolerance, and expected return on investment.

Appraised Value

This is the value assigned to a property by a professional appraiser, based on their analysis of the property’s characteristics, comparable sales, and other relevant factors.

Assessed Value

This is the value assigned to a property by a government tax assessor for the purpose of calculating property taxes.

Replacement Value

This is the cost to replace a property with one of similar utility, but not necessarily identical, in the event of destruction or damage.

Rental Value

The potential income a property can generate through rent payments

Development or Redevelopment Value

The value added to a property through improvements, renovations, or development projects that enhance its utility, attractiveness, and potential income.

Strategic Value

The value a property holds for a particular investor or developer due to its location, potential for future development, or alignment with their overall investment strategy.

Environmental Value

The value a property holds due to its ecological or environmental significance, such as proximity to parks, green spaces, or conservation areas.

Historical or Cultural Value

The value a property holds due to its historical, cultural, or architectural significance, which can make it attractive to preservation-minded investors or organizations.

Zoning or Land Use Value

The value a property holds based on its current zoning designation and allowable land use, which can influence its potential uses and income-generating capabilities.

Operational Value

The value added through operational improvements, such as better property management, cost-saving measures, and increased efficiency.

Aesthetic Value

The value a property holds due to its visual appeal, design, and aesthetic features.

Access and Connectivity Value

The value a property holds based on its accessibility to transportation networks, amenities, and services.

Demand-Supply Dynamics

The value a property holds based on the balance between supply and demand in the local real estate market.

Market Timing Value

The value added by purchasing or selling a property at the right time in the market cycle.

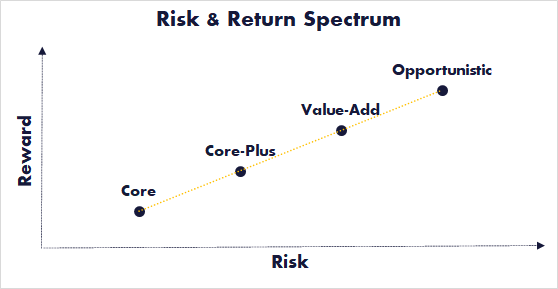

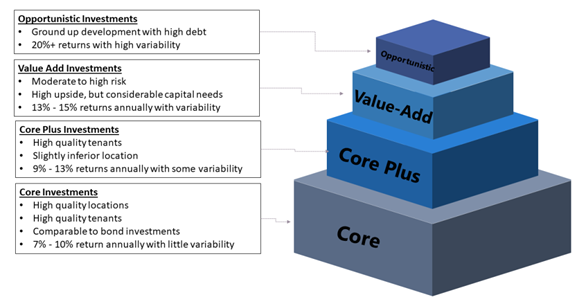

The Common Trend in real estate investment

From an investment standpoint, real estate deals sometimes can be defined as either stabilized or value add.

Stabilized or value-added?

TABILIZED real estate

Key Characteristics of a Stabilized real Estate Investment

High Occupancy

The property has achieved a high occupancy rate, with a majority of its rental units or spaces leased to tenants.

Consistent Rental Income

The property is generating regular and predictable rental income from its tenants, resulting in stable cash flow for the investor.

Operational Efficiency

The property’s operations, including management, maintenance, and tenant relations, are running smoothly and efficiently.

Market Recognition

The property has gained recognition and established a reputation in the local market, making it more attractive to potential tenants and investors.

Minimal Vacancy Risk

The risk of significant vacancies or prolonged periods of low occupancy has been minimized, providing a degree of income stability.

Financial Stability

The property’s financial performance is stable, and it has demonstrated its ability to cover operating expenses, debt service, and potentially provide a return to investors.

Reduced Capital Expenditure Needs

Major renovations or capital expenditures required for the property to function optimally have been completed during the initial lease-up phase.

Lower Lease-up Costs

Costs associated with marketing, tenant incentives, and other lease-up expenses have decreased as the property has become established.

Stabilized real estate investments are generally considered less risky than properties in earlier stages of development or lease-up. They often attract long-term investors seeking consistent income streams and potential appreciation. Investors in stabilized properties may include individuals, real estate investment trusts (REITs), institutional investors, and private equity funds.

It’s important to note that achieving stabilization may vary based on property type (e.g., residential, commercial, industrial), market conditions, location, and the specific strategies employed by the investor or property owner.

VALUE ADD REAL ESTATE INVESTING

value add REAL ESTATE

Certainly, there are several types of value-add real estate investments that can potentially offer attractive returns by improving the property and increasing its income-generating potential.

When considering value-add real estate investments, it’s important to conduct thorough due diligence, assess market conditions, understand the potential risks, and have a well-defined strategy for achieving the desired improvements and returns. Working with experienced professionals such as real estate agents, property managers, and contractors can also greatly contribute to the success of your investment.

Renovation and Rehabilitation: This involves purchasing properties in need of significant repairs or upgrades and renovating them to increase their value. Examples include updating outdated kitchens and bathrooms, replacing roofing or flooring, and enhancing curb appeal.

Green Initiatives: Implementing energy-efficient upgrades such as solar panels, energy-efficient HVAC systems, and sustainable landscaping can attract eco-conscious tenants and reduce operating costs over time.

Repositioning: Repositioning involves changing the positioning or target market of a property to attract a different tenant base. For instance, converting a rundown office building into luxury apartments or turning an industrial space into trendy loft-style offices.

Technology Integration: Incorporating smart home technologies, high-speed internet access, and other tech amenities can make a property more appealing to modern tenants.

Conversion: Converting a property from one use to another can add value. This could involve converting a warehouse into residential lofts, repurposing a school building into a senior living community, or turning a hotel into condominiums.

Amenity Addition:

Adding amenities like fitness centers, communal workspaces, rooftop gardens, and pet-friendly facilities can increase tenant satisfaction and justify higher rents.

Mixed-Use Developments: Creating mixed-use properties that combine residential, commercial, and retail spaces can cater to a wider audience and generate multiple income streams. For instance, a building with apartments above and retail shops below.

Property Management Improvement: Enhancing property management practices can lead to better tenant relationships, reduced vacancies, and improved overall property performance.

Lease Restructuring: Acquiring properties with underperforming leases and renegotiating those leases to increase rental income. This could include adjusting rents to market rates or improving lease terms to attract higher-quality tenants.

Value-Add Land Development: Purchasing raw land in locations with growth potential and obtaining necessary zoning changes or entitlements for development can create significant value when selling to developers.

Scenario: Upgrading a Multi-Family Residential Property

Property Type: Multi-family residential apartment complex Current State: The property is a well-located but outdated apartment complex with below-market rents and deferred maintenance issues. It has a 75% occupancy rate.

Value-Add Strategy:

Renovations and Upgrades

The investor plans to renovate the property by upgrading the units with modern amenities, new appliances, updated fixtures, fresh paint, and improved landscaping. This will enhance the overall appeal of the property and allow for higher rent rates.

Improved Management

Implementing professional property management to enhance tenant relations, address maintenance requests promptly, and ensure effective lease enforcement to attract and retain quality tenants.

Marketing and Branding

Rebrand the property with a new name, lRebrand the property with a new name, logo, and marketing materials to create a fresh image that appeals to the target tenant demographic.ogo, and marketing materials to create a fresh image that appeals to the target tenant demographic.

Amenity Addition

Add value by introducing new amenities such as a fitness center, communal lounge, and outdoor gathering spaces to enhance the lifestyle experience for residents.

Energy Efficiency Upgrades

Implement energy-efficient improvements such as LED lighting, programmable thermostats, and insulation upgrades to reduce utility costs and attract environmentally-conscious tenants.

Lease-Up Campaign

Launch a targeted marketing and lease-up campaign to attract new tenants and fill the remaining vacancies. Offer move-in specials or reduced security deposits to incentivize leasing.

Rent Increases

Gradually increase rents as the property’s condition and amenities improve, bringing them closer to market rates while still providing good value to tenants.

Expected Outcomes

Increased Occupancy

Through renovations, improvements, and effective management, the occupancy rate increases from 75% to 95% within the first year.

Higher Rental Income

The combination of higher occupancy and increased rents leads to a significant boost in rental income, resulting in improved cash flow for the investor.

Property Appreciation

The property’s value increases over time as it becomes more attractive to tenants and the local market recognizes the improvements made.

Enhanced Tenant Experience

Tenants enjoy a better living environment with modern amenities and responsive management, leading to higher tenant satisfaction and retention.

Competitive Advantage

The property’s improved condition and amenities give it a competitive edge in the local rental market, helping it maintain strong occupancy levels and potentially outperform neighboring properties.

Potential Exit Strategy

After several years of stable operations and value creation, the investor may consider selling the property at a higher price, capitalizing on the increased value generated through the value-add strategy.